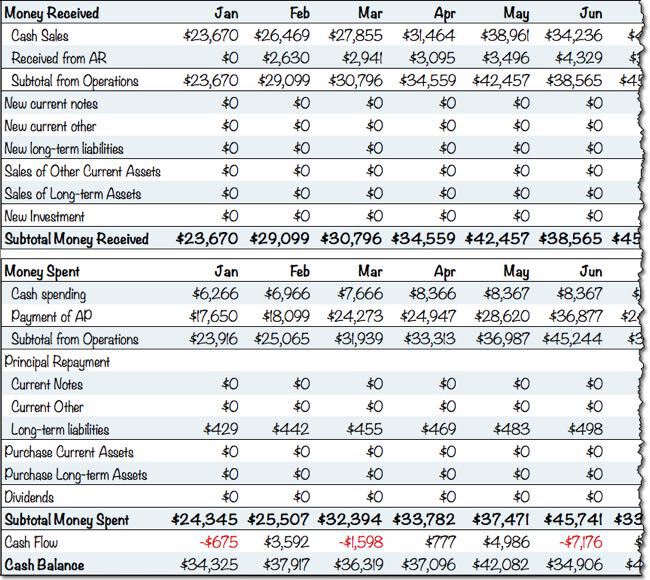

When the production budget is determined from the sales, management prepares the direct materials budget to determine when and how much material needs to be ordered. One such example are direct material purchases, which originates from the direct materials budget. The cash payments schedule, on the other hand, shows when cash will be used to pay for Accounts Payable. These are listed individually in the cash inflows portion of the cash budget. When the cash collections schedule is made for sales, management must account for other potential cash collections such as cash received from the sale of equipment or the issuance of stock. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license) An estimate of the net realizable balance of Accounts Receivable can be reconciled by using information from the cash collections schedule:Ĭash Collections Schedule for Big Bad Bikes. (Figure) illustrates when each quarter’s sales will be collected. This leaves 5% of the sales considered uncollectible. In the quarter after the sale, 30% will be collected. In the quarter of sales, 65% of that quarter’s sales will be collected. They believe cash collections for the trainer sales will be similar to the collections from their bicycle sales, so they will use that pattern to budget cash collections for the trainers. To illustrate, let’s return to Big Bad Bikes. Bad debts also need to be estimated, since that is cash that will not be collected. Since purchases are made at varying times during the period and cash is received from customers at varying rates, data are needed to estimate how much will be collected in the month of sale, the month after the sale, two months after the sale, and so forth. The cash collections schedule does as well. The operating budgets all begin with the sales budget. When everything is combined into one budget, that budget shows if financing arrangements are needed to maintain balances or if excess cash is available to pay for additional liabilities or assets. The cash budget, then, combines the cash collection schedule, the cash payment schedule, and all other budgets that plan for the inflow or outflow of cash. Both the cash collections schedule and the cash payments schedule are included along with other cash transactions in a cash budget. The cash payments schedule plans the outflow or payments of all accounts payable, showing when cash will be used to pay for direct material purchases. The cash collections schedule includes all the cash expected to be received and does not include the amount of the receivables estimated as uncollectible. The cash collections schedule includes all of the cash inflow expected to be received from customer sales, whether those customers pay at the same rate or even if they pay at all. This line of credit would be similar in function to the overdraft protection offered on many checking accounts.īecause the cash budget accounts for every inflow and outflow of cash, it is broken down into smaller components. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)Ĭash is so important to the operations of a company that, often, companies will arrange to have an emergency cash source, such as a line of credit, to avoid defaulting on current payables due and also to protect against other unanticipated expenses, such as major repair costs on equipment.

0 kommentar(er)

0 kommentar(er)